In 2024 alone, global private aviation traffic advanced pre-COVID levels, with many operators reporting record bookings and fleet utilisation. The alignment of wealth creation, technological maturity, and health-driven travel preferences has propelled this market into uncharted altitudes. Yet, with its ascent comes turbulence, with environmental scrutiny, regulatory tightening, and geopolitical headwinds rapidly reshaping the landscape.

This article unpacks the key dynamics behind private aviation’s growth. We assess the structural changes transforming access and ownership, and the pressing need to balance aspiration with accountability. Drawing from UK, Swiss, and global trends, we explore how private jets are redefining the very idea of travel and what it means for clients navigating the skies ahead.

Private jets: A snapshot of a soaring industry

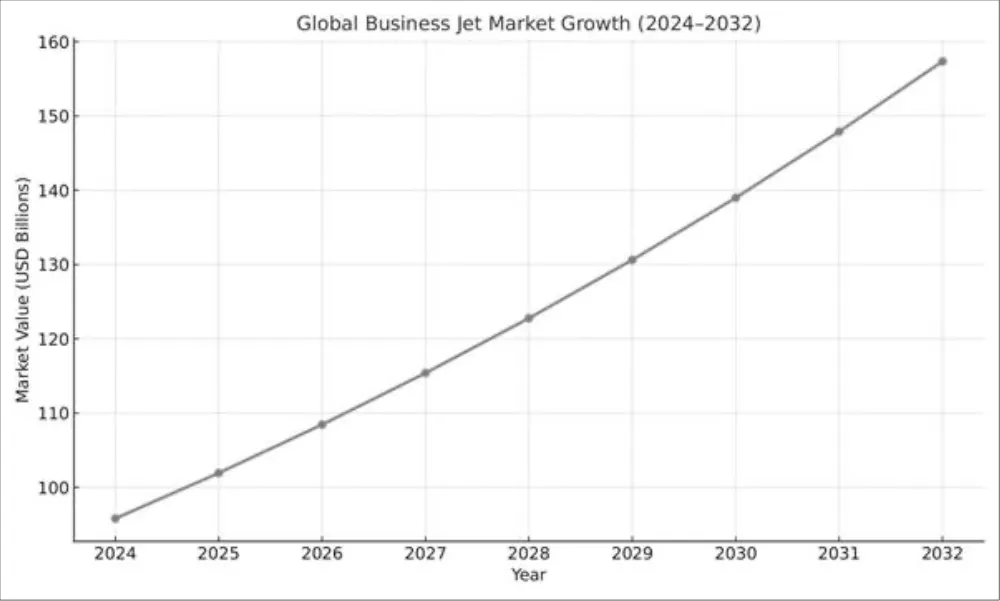

Business jet growth trajectory and market size

The global business jet market, valued at approximately $95.8 billion in 2024, is projected to reach nearly $157 billion by 2032, growing at a CAGR of 6.4%. The United States remains the dominant market. However, Europe, particularly the UK, France, Switzerland, and Germany, is driving the next phase of strategic expansion. The pandemic triggered a spike in first-time flyers. Many have stayed, drawn by the value proposition of time efficiency, discretion, and control.

In the UK, London’s leading airports with private jet terminals, including Farnborough, Biggin Hill, and Luton, recorded a significant 26% increase in flight movements in 2023. There was a further average rise of 7% in 2024, reflecting sustained demand from business and UHNW travellers. Switzerland’s Geneva and Zurich remain top continental hubs, supporting UHNW individuals and asset managers operating across borders.

The New Luxury Consumer Class: Strategic Asset Buyers vs Emerging Non-Owners

Gone are the days when private jets were the preserve of trophy hunters. Today’s clientele, from tech founders to global family offices, is pragmatic, privacy-conscious, and purpose-driven. Many are young, mobile, and digitally native. They value experiential luxury, sustainability, and bespoke services to aid their productivity over displays of wealth.

According to a report by IPS, the average private jet owner has a net worth of $190 million. Top sectors include real estate, private equity, and tech. More interestingly, the fastest-growing user group is ‘non-owners’. This category highlights those investing in jets through charter, jet cards, or fractional shares.

Models of Access: Beyond Ownership of Private Jets

Private aviation is increasingly recognised as a strategic financial decision. Though ownership is no longer the only path to benefit from these tangible assets. Those who are yet to own a private jet are leveraging alternative models as part of their investment. Fractional ownership, charter, and jet cards offer greater flexibility. The following innovations reduce barriers to entry into this once-exclusive space.

On-Demand Private Jet Charter

On-demand charter remains the most flexible point of entry. With thousands of aircraft available globally, clients can select from a fleet of jets suited to mission, budget, and preference. As a result, there are no maintenance, compliance, or depreciation burdens. Digital platforms such as VistaJet, FlyVictor, and NetJets offer app-based booking, price transparency, and real-time aircraft tracking.

Jet Cards and Memberships

Jet cards offer a middle ground. The membership gives access to pre-purchased hours, guaranteed availability, and fixed pricing. Providers like Air Partner, Wheels Up, and XOJet have tailored offerings for the frequent flyer who values reliability over asset appreciation.

These models are proving especially popular in Switzerland and the UK, where clients seek EU mobility post-Brexit, stable pricing, and minimal operational hassle.

Fractional Ownership and Leasing

Fractional ownership models, pioneered by NetJets, allow clients to own a “share” of an aircraft. Typically, 1/16 to ¼, the shareholder is entitled to a fixed number of flight hours per year. These models are capital-intensive upfront. But, tax advantages and fixed cost predictability make the investment especially attractive to corporate users.

Operating leases are gaining traction too, particularly among younger UHNW clients who prefer asset-light investment strategies.

Sustainability in the crosshairs

Carbon and climate pressure

Private aviation emits significantly more CO₂ per passenger than commercial flying. In some cases, this is up to 10x more, especially on short-haul routes. With climate consciousness rising and legislation tightening, the industry is under immense pressure to decarbonise.

In 2024, the UK government proposed extending higher Air Passenger Duty (APD) rates. This would apply to all private jets, regardless of weight or seating capacity. This move reflects a shift toward the “polluter pays” principle and may spark similar policy changes across the EU.

SAF: Sustainable Aviation Fuel

While electric and hydrogen propulsion remain distant dreams for long-haul aviation, SAF (sustainable aviation fuel) is the most viable near-term solution. Made from bio-based feedstocks like used cooking oil, SAF can reduce lifecycle emissions by up to 80%.

Yet, supply remains limited, and costs are 3–5x higher than conventional Jet A1. Only 0.2% of global aviation fuel in 2023 was SAF. Scaling up production and passing costs onto end users will be key.

Carbon Offsetting and Innovation

Many providers offer carbon offset programmes. Yet the efficacy of these schemes is mixed. Clients increasingly demand transparent, audited solutions that go beyond greenwashing. Firms like Momentum Jets and Air Partner now partner with verified offset providers and are exploring blockchain-based fuel traceability.

Regulatory Realignment: The New Rules of the Sky

APD Reform in the UK

The UK’s proposed APD reform will increase the duty by 50% for private jet users. Included in the reform, the higher rate will be extended to lighter aircraft and those with more than 19 seats. This could have a chilling effect on certain leisure-focused short-haul routes but is unlikely to curb executive travel demand.

EU Green Deal & Emission Trading Schemes

The EU is revising the Emissions Trading Scheme (ETS) to include more private and business aviation operators. Flights within the EEA are subject to allowances, while SAF incentives are being proposed in tandem with ReFuelEU initiatives.

Expect regulatory convergence and increased reporting obligations by 2026.

Airspace and Geopolitics

Geopolitical conflicts have reshaped airspace usage. Sanctions on Russia have closed key routes, forcing longer flight paths between Europe and Asia. This has increased fuel consumption and challenged route profitability for charter operators.

Financing the Skies: A Wealth Manager’s Guide

Cash is King But Not Always Optimal

According to the Business Aircraft Report by Equipment Leasing & Finance Foundation, up to 70% of private jet purchases are now made with cash. While appealing for speed and simplicity, this ties up capital and exposes buyers to asset depreciation. Savvy UHNW clients are turning to structured finance solutions. UHNW individuals are leveraging aircraft as part of wider estate planning or succession structures.

Lending, Leasing, and ABS

Aircraft leasing and asset-backed securities (ABS) are enjoying a resurgence. Lenders are more cautious post-pandemic but willing to finance newer aircraft with strong residuals. Family offices across the world are also exploring aviation as an alternative asset class, especially in Switzerland and the Channel Islands.

The UK and Swiss Angle: Tailored Opportunity

The UK Landscape

The UK remains one of Europe’s largest private aviation markets, underpinned by London’s global finance hub, its elite schools, and cross-border families. Brexit, however, has complicated aircraft registration, VAT compliance, and cabotage. Clients increasingly seek multi-jurisdictional support for planning flights, basing aircraft, or navigating APD.

Switzerland: Neutral, Nimble, Connected

Switzerland offers stable regulation, low tax, and access to continental Europe, ideal for aircraft ownership structures. Zurich and Geneva remain powerful aviation hubs, especially for family offices managing intergenerational wealth. Swiss HNWs are showing rising interest in sustainable aviation, philanthropy-linked travel, and investing in green aviation startups.

The Future of Private Aviation: Quiet Luxury and Purpose

From Status to Strategy

Private jets are no longer just about status. For clients, they are strategic tools. Private aviation unlocks opportunities, compressing time and ensuring control in an unpredictable world.

The emphasis is shifting to quiet luxury, thoughtful interiors, subtle branding, curated in-flight experiences, and purpose-driven travel.

The Role of Advisors

Wealth advisors, trustees, and private bankers are increasingly central to aviation decisions. From advising on cross-border VAT to integrating aircraft ownership into a trust or corporate structure, their role is to ensure clients fly smarter, not just higher.

Lift with Purpose

Private aviation is entering a new phase. It is bigger, broader, and more scrutinised than ever. For clients across the UK and Switzerland, it represents both freedom and responsibility.

The skies are full of promise, but navigating them requires insight, innovation, and integrity. At Henry Dannell, we help you plot a flight path that is strategic, sustainable, and deeply personal.

Welcome to the next generation of private aviation.